Key Rules and Compliance Aspects for Physical Asset Verification in India

Introduction:

Navigating India’s Regulatory Landscape for Physical Asset Verification

Adherence to Rules and Compliance is Paramount

In the intricate world of India’s regulatory framework for Key Rules and Compliance Aspects in Physical Asset Verification. Hence, adherence to rules and compliance is of paramount importance, particularly in the realms of finance, taxation, and public administration. Thus, these behaviors are shaped by a variety of legal frameworks and regulatory agencies.

Regulatory Framework for Physical Asset Verification

The Income Tax Department, under Section 142(2A) of the Income Tax Act, 1961, has the authority to mandate physical asset verification during audits. So, the Goods and Services Tax (GST) Act outlines rules, including physical asset verification, and the Companies Act, 2013, mandates periodic audits. Additionally, financial institutions are provided with detailed instructions for physical asset verification, especially for collateral evaluation or lending purposes, under the Banking Regulation Act.

Key Aspects and Regulations Influencing Physical Asset Verification

In India, the rules and compliance related to physical asset verification are governed by various regulatory bodies and laws. Particularly in sectors such as finance, taxation, and public administration. Here are some key aspects and regulations that could influence physical asset verification in India.

1. Income Tax Act, 1961

Under Section 142(2A) of the Income Tax Act, the Income Tax Department can mandate a taxpayer to get their books of accounts audited, including physical verification of assets.

2. Companies Act, 2013

Companies are required to maintain proper books of accounts and undergo periodic audits, including physical verification of assets. Section 143 of the Companies Act mandates statutory auditors to verify and report on the physical existence of assets.

3. Goods and Services Tax (GST) Act

For businesses registered under GST, there are provisions for maintaining proper records and undergoing audits that may include physical verification of assets to ensure compliance with GST regulations.

4. Banking Regulation Act

Financial institutions, governed by the Banking Regulation Act, may have specific guidelines regarding the verification of physical assets, especially for collateral assessment or loan purposes.

5. Central Public Procurement Portal (CPPP)

In government procurement, the Central Public Procurement Portal may have specific guidelines for physical asset verification in the context of asset management and accountability.

6. Indian Accounting Standards (Ind AS)

Applicable accounting standards may require entities to conduct periodic physical verification of assets to ensure accurate financial reporting.

7. Central Board of Direct Taxes (CBDT) Guidelines

CBDT may issue guidelines and notifications regarding the verification and substantiation of assets during tax assessments.

8. Regulatory Authorities

Various regulatory bodies such as Securities and Exchange Board of India (SEBI), Reserve Bank of India (RBI), Insurance Regulatory and Development Authority of India (IRDAI), etc., may have their guidelines pertaining to physical asset verification for entities under their respective jurisdictions.

9. Customs and Excise Regulations

Importers/exporters might be subjected to physical verification of assets as part of customs or excise compliance.

10. State-Specific Regulations

Some states in India might have specific regulations or requirements concerning asset verification, especially in sectors like real estate, infrastructure, etc.

These regulations and guidelines may require businesses, institutions, or individuals to conduct periodic physical verification of assets, maintain proper documentation, ensure compliance with accounting and taxation standards, and undergo audits by authorized entities or auditors.

It’s important to refer to the specific laws, regulations, and notifications issued by relevant authorities for precise details and compliance requirements regarding physical asset verification in India. Seeking guidance from legal or financial experts well-versed in Indian regulatory frameworks can help ensure adherence to these rules.

Compliance Requirements for Physical Asset Verification

These regulations and guidelines may require businesses, institutions, or individuals to:

- Conduct periodic physical verification of assets

- Maintain proper documentation

- Ensure compliance with accounting and taxation standards

- Undergo audits by authorized entities or auditors

Best Asset management company in India

In the realm of efficient asset management. The discerning entities often seek the services of the best Asset management company in India to navigate the complexities of compliance and optimization.

Top IT asset management software

Selecting an appropriate asset management system is essential for companies looking to optimize their processes and guarantee adherence to the various laws controlling physical asset authentication.

Top asset management software

Investing in the best IT asset management software is essential for businesses that focus on information technology assets to keep control and compliance over their digital infrastructure.

Best compliance software for asset management

Adopting the best asset management software provides a complete approach to managing and optimizing a wide range of physical assets, going beyond industry-specific solutions. The finest compliance software for asset management is essential to ensure that efficient asset management extends to compliance.

Seeking Expert Guidance

It is crucial to refer to the specific laws, regulations, and notifications. These are issued by relevant authorities for precise details and compliance requirements regarding physical asset verification in India. Seeking guidance from legal or financial experts well-versed in Indian regulatory frameworks can help ensure adherence to these rules.

Role of Asset Management Companies, Systems, and Software

In the realm of efficient asset management, discerning entities often seek the services of the best Asset management company in India to navigate the complexities of compliance and optimization. Choosing the right Asset management system and Top IT asset management software is crucial for businesses aiming to streamline their operations and ensure compliance with the diverse regulations governing physical asset verification.

Conclusion: Navigating the Complexities of India’s Regulatory Environment

Businesses, institutions, and individuals must carefully follow the various regulations. Also, governing physical asset verification when negotiating the complexities of India’s regulatory environment. A thorough strategy is necessary to ensure compliance with several rules such as the Companies Act, GST Act, Income Tax Act, and guidelines from the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI). State-specific laws and industry-specific norms emphasize the importance of due diligence even more. Especially, when it comes to infrastructure and real estate. It becomes essential to seek advice from legal or financial professionals knowledgeable about Indian regulatory systems in order to properly navigate this challenging terrain. This guarantees effective asset management in line with industry best practices. Also, adherence to the numerous laws and regulations.

- Published in Technology

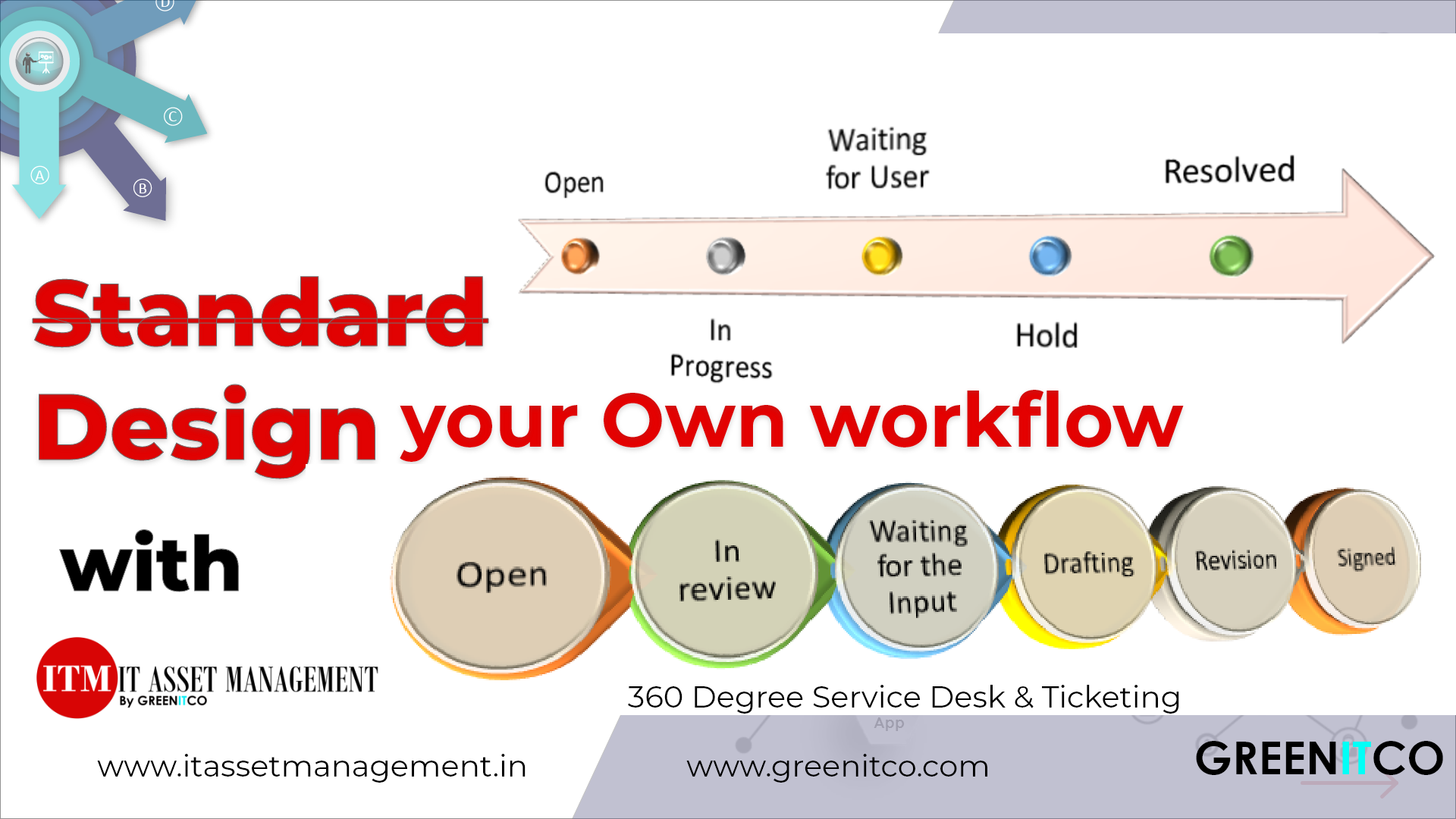

Customize Ticketing System

While using a standard workflow for ticketing has its advantages, there are also situations where customize ticketing System workflow using an ITM ticketing system can be beneficial.

Here are some reasons why:

- Specific business needs: Every organization is unique, with different business needs and workflows. Using a standard workflow may not be suitable for all situations, and customization may be necessary to address specific business needs.

- Increased efficiency: Customizing the workflow can help to streamline processes and reduce the time required to complete tasks. By automating repetitive tasks and removing unnecessary steps, you can improve the efficiency of your ticketing system.

- Improved user experience: Customizing the workflow can help to create a better user experience for your team members. By tailoring the system to their needs, you can make it easier for them to manage tickets and prioritize tasks.

- Customize Ticketing System Greater flexibility: Greenitco ITM customization allows you to be more flexible in how you handle tickets. You can create workflows that are unique to specific teams or departments, and adjust them as needed to reflect changes in your business.

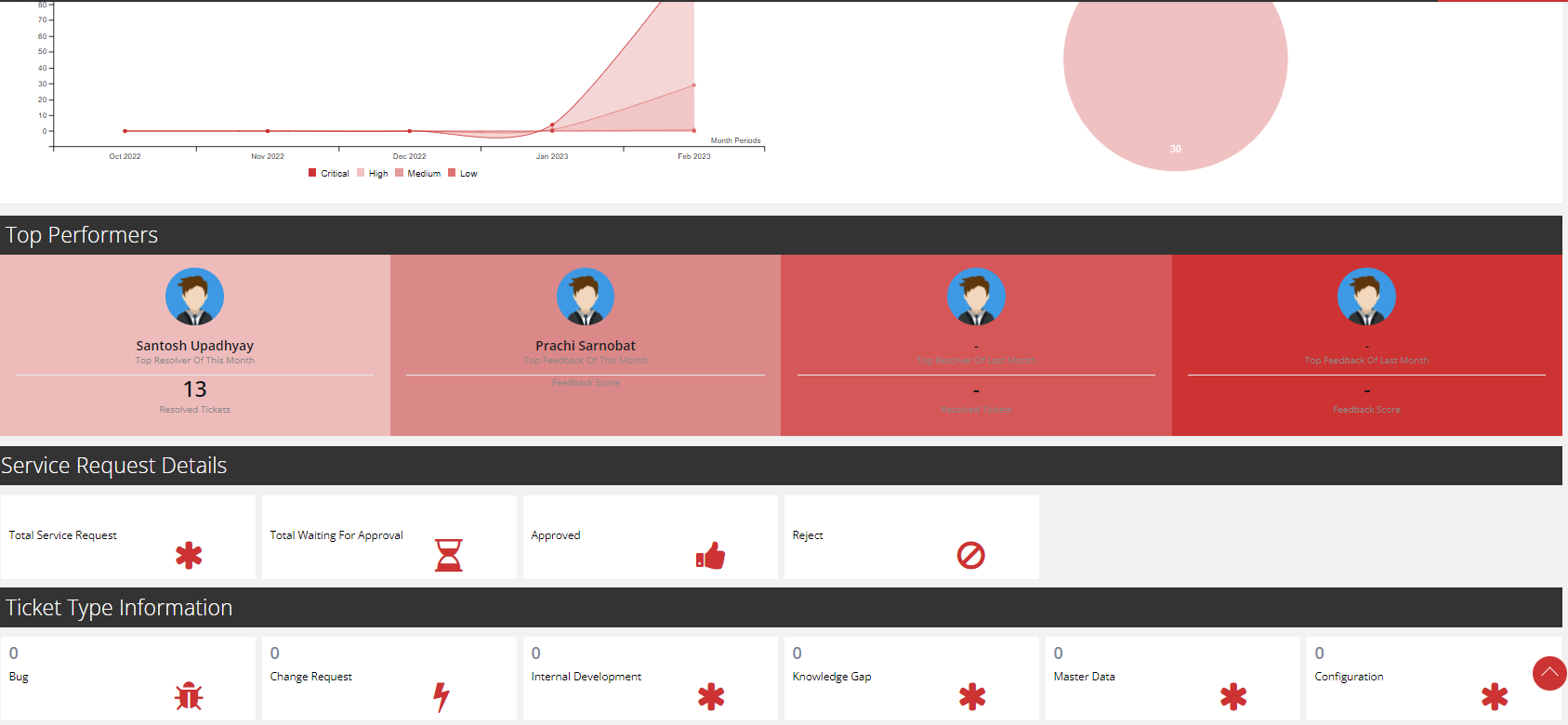

- Enhanced reporting: Customizing the workflow can allow you to gather more detailed information on how tickets are handled. This can help you to identify trends and patterns, and make data-driven decisions to improve your ticketing processes.

- Competitive advantage: By customizing your ticketing system, you can differentiate your business from competitors who use standard workflows. This can help to improve customer satisfaction and drive revenue growth.

- Greenitco Asset Management supports all kinds of departments from finance, HR, IT Infra, IT Applications, Mobility, Legal, etc to create their own workflow and statutes as per org culture. This can help to track all kinds of issues, SLA, and KPIs related to all the department

It is important to note that customization should be done carefully, as it can be costly and time-consuming. It is important to identify the specific needs of your organization and prioritize customization efforts accordingly. Additionally, any customization should be well-documented and tested thoroughly to ensure that it is stable and does not introduce any new issues.

- Published in Technology